In the inaugural Network Vendor Diversity report, Auvik discovered high diversity in the network devices IT teams and MSPs were managing. In 2019, the data showed complexity continuing to rise as all categories became increasingly fragmented.

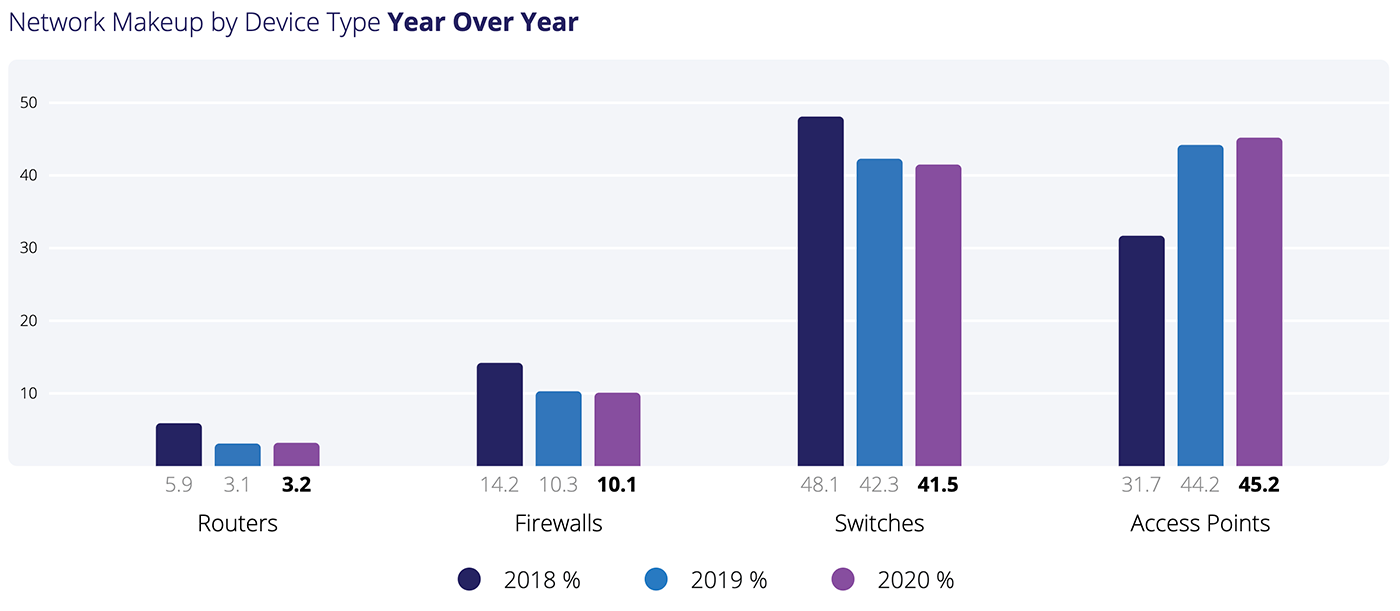

In the 2020 edition, we look at the same four categories of managed network devices—access points, switches, routers, and firewalls—deployed across a sample of 30,000 networks, and compared the data to both 2018 and 2019.

As we analyzed the data, we identified some interesting trends taking place on today’s networks. Dive into the top three trends—and the data behind them—below.

1. The market is becoming increasingly crowded and competitive

The number of network device vendors included in this report grew by 26 this year, with 14 new switch vendors, 13 new router vendors, and 2 new firewall vendors being accounted for, totalling a whopping 368 vendors on today’s networks.

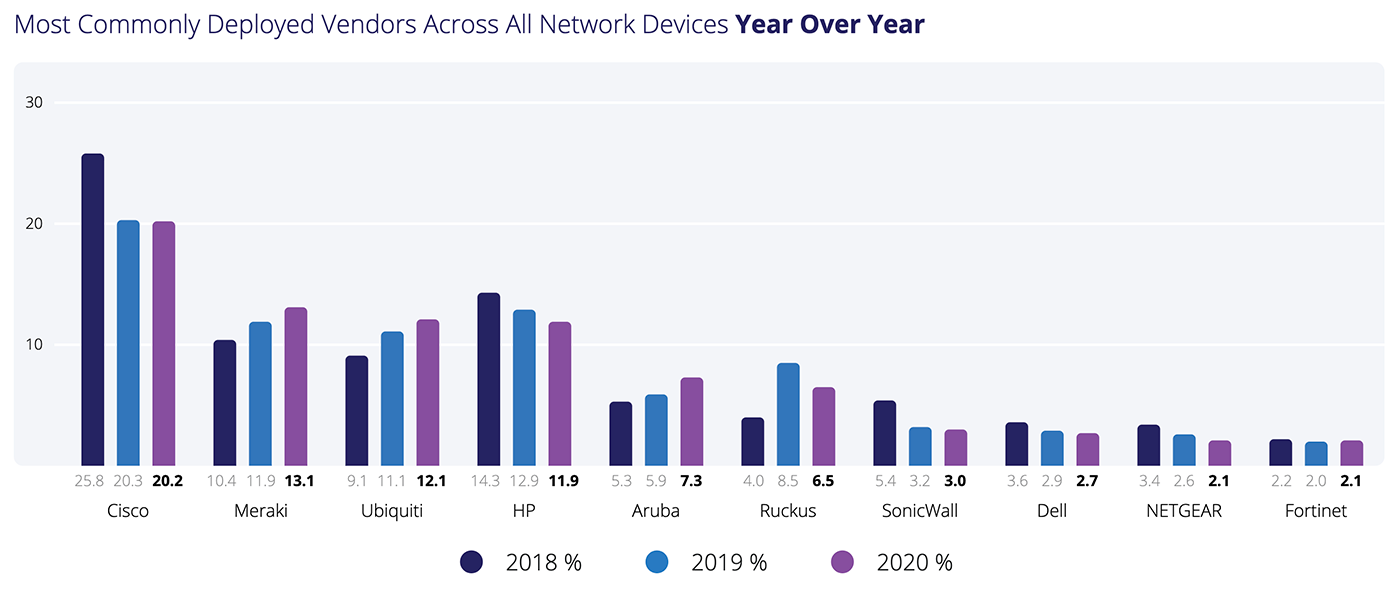

The top nine most commonly deployed vendors across all device categories—Cisco, Meraki, Ubiquiti, HP, Aruba, Ruckus, SonicWall, Dell, NETGEAR, and Fortinet—claim around 80% of devices across all networks, leaving 358 other vendors fighting for less than 20% of the market.

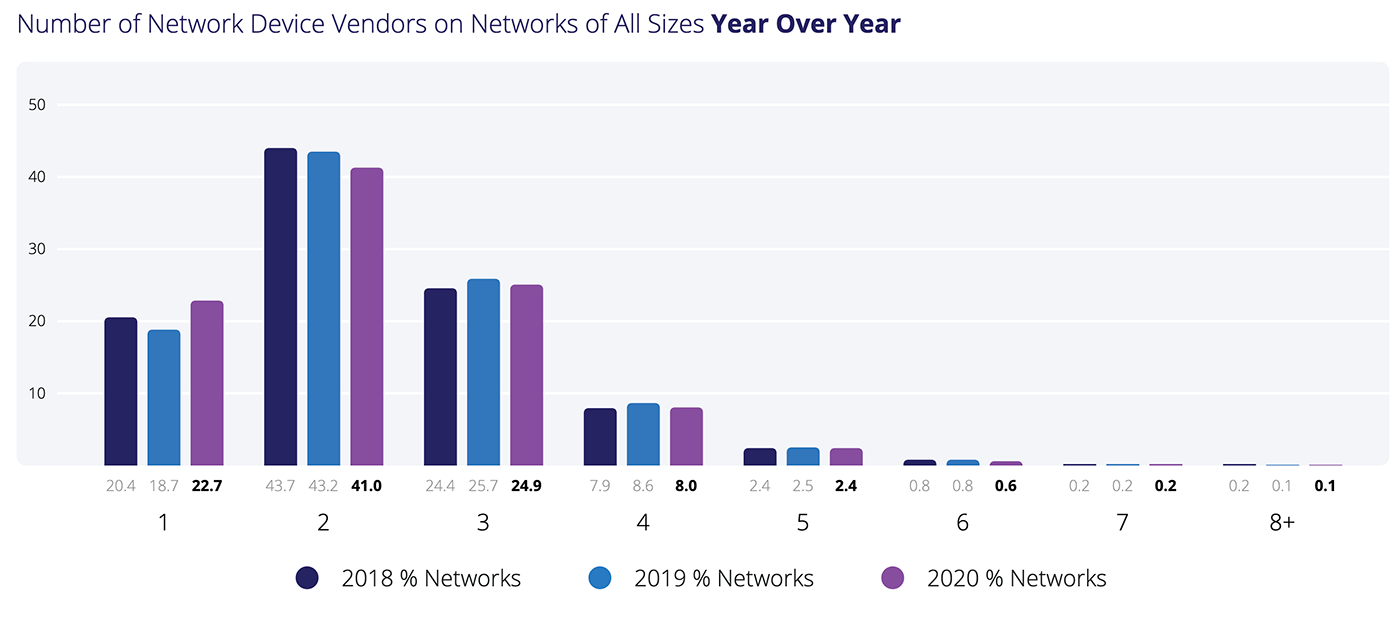

What effect does the number of vendors and the competitive hardware market have on the networks themselves? As it turns out, there’s not much of one—the number of different vendors on networks of all sizes remains relatively low.

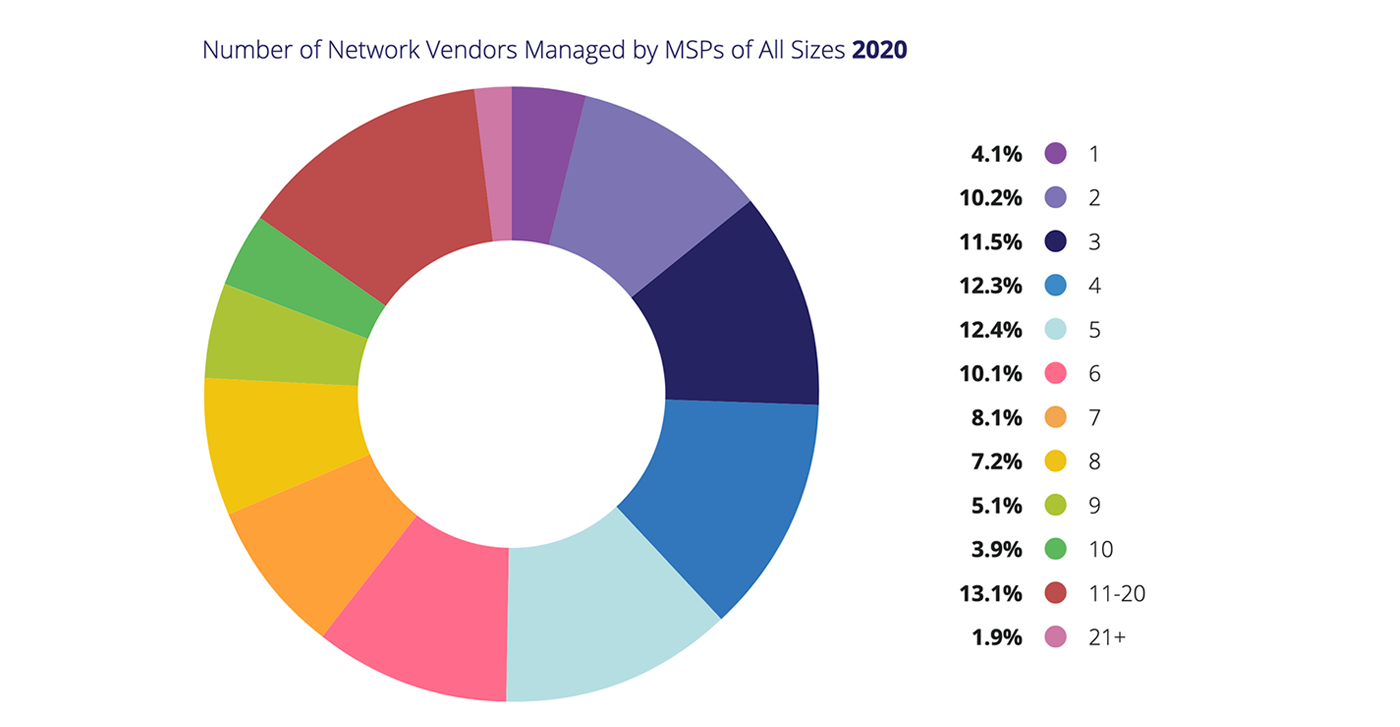

While each site is getting simpler, the complexity is still there, especially if you’re an MSP who’s managing multiple sites. Just take a look:

Nearly two-thirds of all MSPs are managing five or more network device vendors across their clients. As an MSP gets larger, so does the number of network device vendors they’re responsible for managing. For large MSPs, the median number of network device vendors managed is up by two in the past year to 15.

2. Distributed work is affecting network trends

Thanks to COVID-19, 2020 has been a very unusual year as we shifted to working from home full-time and are now—gradually—moving back into the office in some capacity. This is reflected somewhat in the data as access points continue to make up the bulk of network devices.

We expect access points to continue to make gains next year as more companies adopt distributed work models—where employees can work from home or at the office—because networks will have to evolve to support wireless connectivity.

For example, in the office, employees will want to work anywhere. They’ll want to work at their desk, in the lunchroom, in the lobby, or from common spaces. To do so, they need increased wireless coverage.

Away from the office, employees will want to work in the café down the street, from a library, at a restaurant, and elsewhere. That’s pushing more wireless connectivity in areas that didn’t have it before. (In other words, the small businesses that used to have a home-grade access point for their own personal use will likely have to invest in SMB-grade systems.)

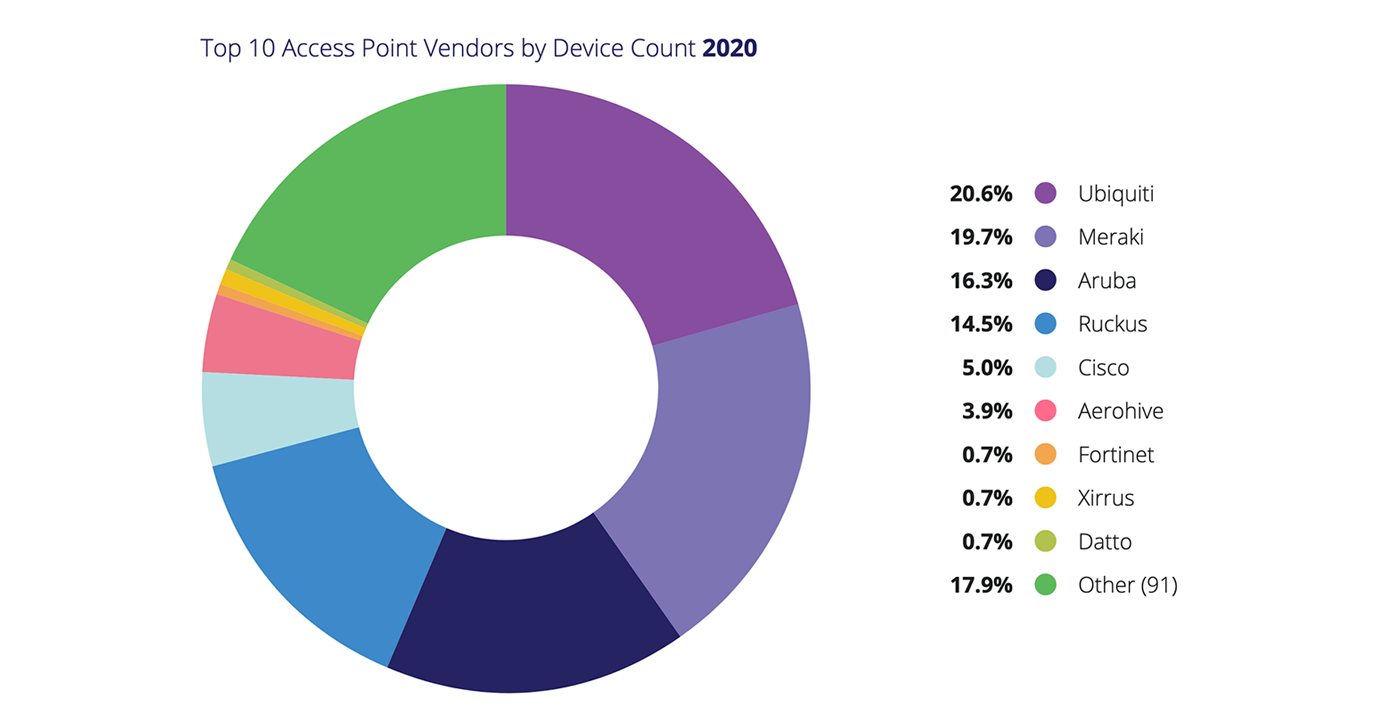

What does increased connectivity mean for access point vendors in an already tightly contested category? There’s two possible scenarios, but first, let’s take a look at this year’s data.

On today’s networks, only 0.9% separates Ubiquiti, the most commonly deployed access point vendor, and second place Meraki, while third place Aruba follows close behind.

Next year, we expect to see a continued battle royale between Ubiquiti, Meraki, and Aruba for the top spot next year—and that’s the most likely scenario. The other possibility is that one of the vendors pulls away as the clear favorite as businesses expand their wireless connectivity and go all in on one vendor. But which vendor would they choose? It depends on what businesses are looking for when purchasing access points:

- Ubiquiti has long been focused on delivering enterprise-level features at an affordable price point, and it’s considered a favorite among those managing small and medium-sized networks.

- Meraki used to be considered an expensive product, but buyers are willing to pay for a solution that just works without a huge time investment.

- Aruba is considered the best-in-class Wi-Fi radio experience and the gear itself is incredibly high quality, but they haven’t focused as much on the software or ease of use, and the access points themselves are quite pricey.

The answer to what they’re looking for may be answered in the next takeaway.

3. User experience is more important than ever

On networks of all sizes, the fastest growing vendors—Meraki and Ubiquiti—have invested heavily in building intuitive products with great user experiences. They also have integrated their products across the whole network stack and have built cloud management systems to make their products easy to deploy and manage.

As a result, they’ve easily leapfrogged HP for second and third place, and their year over year growth suggests the best is yet to come.

One important consideration to note here is that the device portfolio of each vendor, as well as user experience, plays a huge part in the rankings in this category.

Cisco is represented across all four device categories, while Meraki and Ubiquiti are represented in the switch, firewall, and access point categories. In contrast, 99% of HP’s devices represented in this report are switches. As Meraki and Ubiquiti continue to build out their presence in the access point category specifically, we expect to see the vendors in second and third place pull away with a more significant lead.

Want to see all of the data—and more!—behind these three takeaways? Download the 2021 Network Vendor Diversity report for free today.

Your Guide to Selling Managed Network Services

Get templates for network assessment reports, presentations, pricing & more—designed just for MSPs.