High interest rates, inflation, and technological change are creating turbulence in every industry this year—but the financial services sector has been in for an especially bumpy ride. From strict compliance requirements to growing security concerns and rapid change in fintech, IT professionals in the finance industry are continuously challenged to keep up.

Despite those challenges, our trends data shows IT teams in financial services are more streamlined, excel at maintaining backups and documentation, and report better work-life balance. While better funding is often seen as a primary factor behind these strengths, a strong correlation also exists with their tendency to outsource many activities.

We’ll dive into more of these findings in this article, which pulls out the top financial services industry trends from our larger 2024 IT Trends Report to show you what’s impacting IT teams from this industry. Let’s break down these trends so your IT team can better plan for the year ahead, including:

- Remote work models

- Daily support operations

- Work week trends

- Network configuration backups

- Network documentation

- Network tools and vendors

- Outsourcing to MSPs

- Visibility into SaaS apps and SSO

- Automation adoption

- Data security concerns

- Network innovation

Let’s delve into this year’s top trends for IT teams working in finance.

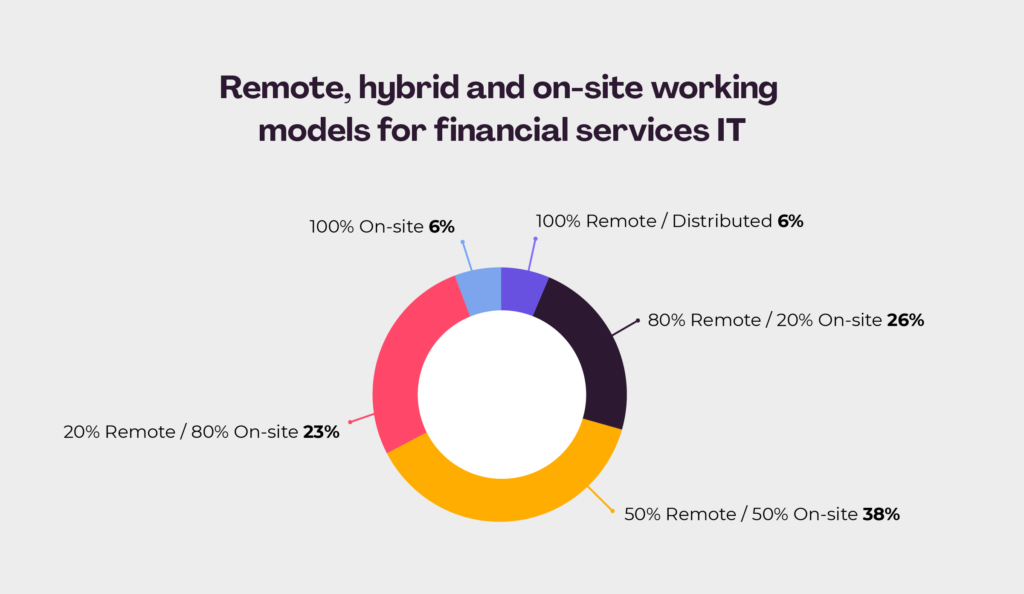

1. The majority of financial services ITs support hybrid work environments

Over 70% of IT professionals in the financial sector support end users who work remotely at least half the time. While this acceleration in remote work can be seen across all sectors, the implications for financial IT teams may carry a heavier weight than other industries.

In 2023, financial services surpassed healthcare as the industry that experiences the most targeted cyberattacks—so much so that one study found cybercriminals are up to 300 times more likely to target the industry than other institutions. Why are cyberattacks so rampant in finance? It’s in part due to the sensitive nature of data held by financial firms that can be highly lucrative for cybercriminals to acquire.

Unfortunately, remote work amplifies this issue. With employees spending less time on desktop applications (38%) and more time on the web (64%) to get their work done—and with more devices, applications, and end points accessing the corporate network than ever before— security risks rise. Because of this, IT teams in the sector are continuously challenged to balance remote accessibility and end user experience with privacy, security, and compliance concerns.

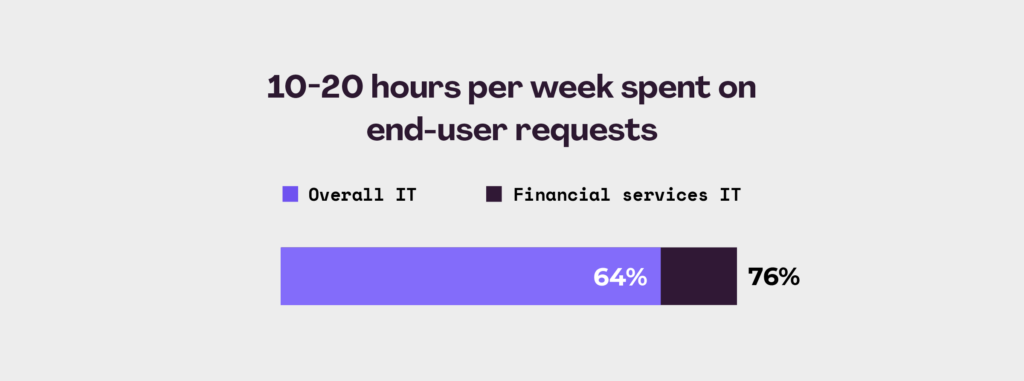

2. Financial services ITs spend less time responding to end-user requests

According to this year’s report, 45% of financial services IT professionals believe end user satisfaction is the most important success metric in their work. It’s no wonder then that 76% of them spend between 10 to 20 hours each week resolving and responding to end-user requests. However, among respondents in the general IT audience, more than 16% are spending more than 20 hours per week on these activities—a figure that drops to just 7% among finance industry respondents.

Overall, this means finance sector IT teams are experiencing greater balance in their daily operations and have a slightly increased ability to step away from troubleshooting to tend to more strategic IT initiatives. In a sector that’s constantly shifting and requires teams to be more proactive than reactive, this is an optimistic outlook.

3. Finance sector ITs have a more balanced work week

The good carries on, because our report shows that IT teams in the financial services sector are much more likely to work an average 40-hour work week than their non-finance industry peers. More than 32% of general IT respondents report working overtime hours in an average week, compared to just 20% of their finance-sector counterparts.

This trend could be attributed to several factors unique to the financial services industry. The first and most data-backed is that some studies show financial institutions are proven to have higher IT budgets as a percentage of revenue (roughly 4% to 11%) than other industries including retail (1% to 3%), healthcare (6% to 9%), and manufacturing (1% to 3%). Higher budgets equate to better resourcing, potentially reducing the need for staff to work overtime. Other factors may include the industry’s emphasis on operational efficiency or a higher technical proficiency amongst office-based end users than in other industries.

Planning for the year ahead?

Find out how IT professionals are managing day-to-day operations, dealing with talent shortages, and preparing for future needs.

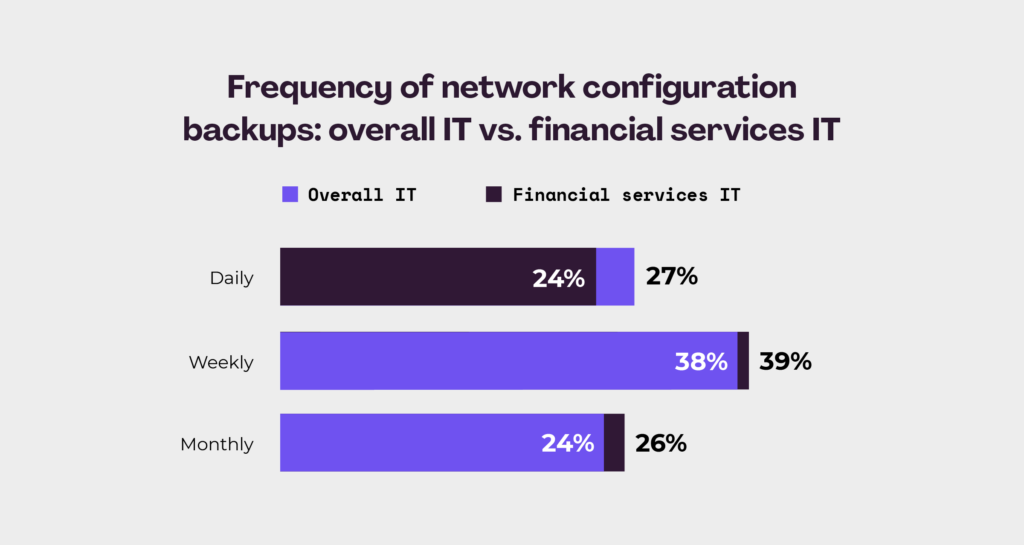

4. Network configurations are backed up frequently in financial services

Fairly on par with other industries, the majority of IT teams in the financial services sector back up their network configurations either daily (24%) or weekly (39%). Given our society’s reliance on financial services firms for everything from daily banking to economic outlooks, this diligent approach to backups is critical for ensuring business continuity and data security.

Financial services firms lose $152M to downtime-related expenses annually. This is why regular backups are increasingly important—helping not only mitigate the risk of data loss but also reduce the time it takes to get up and running in the event of a technical failure, cyberattack, or system error. These proactive measures safeguard sensitive financial information and uphold regulatory compliance requirements—like PIPEDA in Canada and the GLBA in the US—that mandate data protection.

5. Financial services ITs update network documentation more frequently

Financial services IT professionals update network documentation more frequently than the average IT pro. A notable 45% of these IT pros are updating their network documentation—both maps and inventory—on a weekly basis. This rate surpasses that of their peers in other industries, where only 36% follow a similar practice. This practice likely contributes to the reduced time finance ITs spend on end-user requests, as previously mentioned.

Based on what we know about the financial services sector, there are a few reasons finance ITs may be updating their network documentation more frequently:

- Improved troubleshooting: With accurate maps and inventory of the network’s components, IT teams can pinpoint problems more rapidly, reducing downtime and enhancing system reliability. This is particularly critical in high-stakes environments where prolonged downtime can lead to significant financial losses.

- Enhanced security: Regular updates to network documentation can help identify unauthorized changes or discrepancies that could indicate security breaches. By maintaining current records, IT teams can more effectively monitor for vulnerabilities.

- Easier upgrades: Keeping network documentation current simplifies the process of upgrading systems or integrating new technologies, allowing IT pros to assess the existing infrastructure more accurately and plan upgrades without disruptions.

- Regulatory compliance: Financial services are subject to strict regulatory requirements regarding data security and privacy. Up-to-date network documentation supports compliance by ensuring that all network changes are logged and auditable.

What’s also worth noting is that industries like banking need high availability, not just as security from threats but also as a mechanism for delivering the best customer service. IT teams at financial service operations often strive for the five nines of uptime, which would explain why they put their time, effort, and budget investments toward maintaining a strong network. This also accounts for why they would be better documenting their devices and connections.

Overall, the streamlined nature of finance IT teams, which prioritize backups and documentation, may contribute to their more reliable and efficient hybrid work environments, promoting a better work-life balance. This approach could make the financial services industry a model for other market segments to follow.

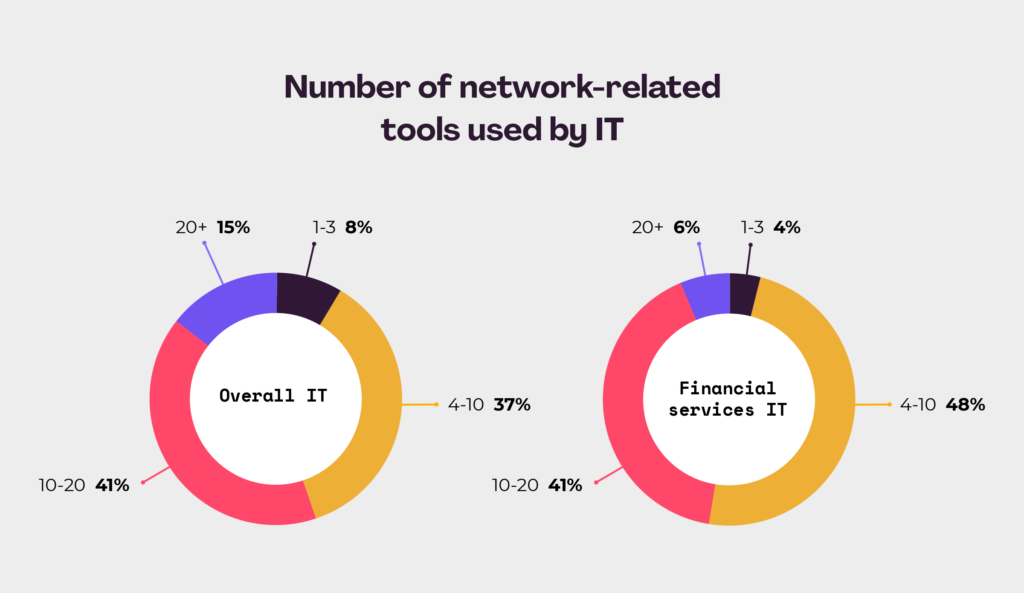

6. Finance ITs use fewer network-related tools than general ITs

Diving into the makeup of their network infrastructure, 44% of financial services respondents said that the majority of network devices are manufactured by the same vendor. While this statistic is fairly aligned with their non-finance peers, there is a notable discrepancy between the quantity of network-related tools being used among the two groups. Nearly half of finance IT professionals (48%) utilize between 4 to 10 network-related tools, whereas their counterparts in other industries typically use between 10 to 20 tools.

These figures suggest that the finance sector may prefer to consolidate vendors and make efficient use of a robust yet refined toolset. This streamlined approach to vendor management could be part of an effort to reduce complexity and maintain strict oversight of the network perimeter for security and compliance purposes.

7. Finance sector ITs are more likely to outsource network-related tasks

Financial services (80%), healthcare (80%), and utilities (87%) are the most likely industries to outsource network-related functions compared to just 72% of general IT pros.

The top outsourced activities as cited by financial services respondents include:

- Configuration backup: Nearly 50% of finance IT professionals are outsourcing backups, acknowledging the importance of safeguarding data against loss or corruption while also ensuring compliance with regulatory standards.

- Troubleshooting: More than 45% of respondents rely on external expertise for troubleshooting, ensuring that issues are resolved efficiently and downtime is minimized with the help of specialized expertise.

- Network configuration: Nearly 45% of respondents are outsourcing configuration to handle the complex demands of their network infrastructure, leveraging specialists to optimize performance and security in a cost-effective manner.

IT outsourcing can free up IT teams to focus on core activities and strategic initiatives while ensuring specialized tasks are handled by a network management MSP. This makes navigating the complexities of financial services IT more manageable, ultimately resulting in greater security and compliance.

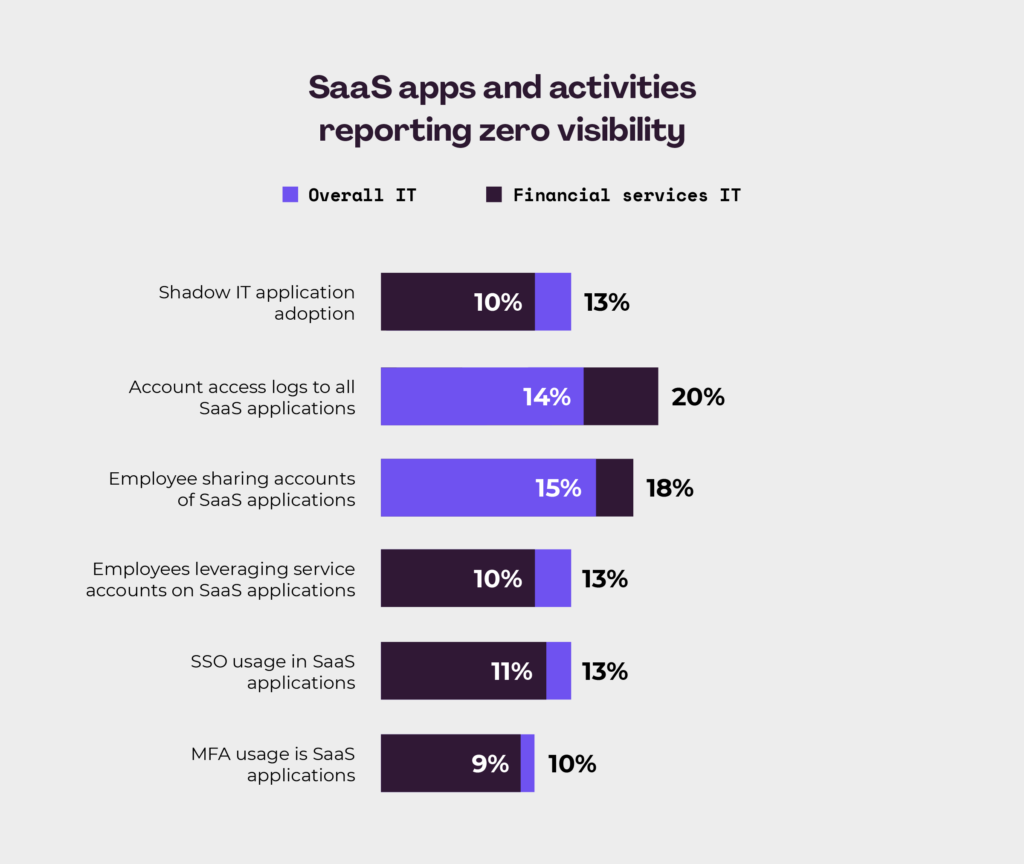

8. Financial service ITs have less visibility into SSO usage for SaaS apps

IT professionals in the financial services space are more likely to have limited visibility into single sign-on (SSO) usage within SaaS applications compared to their general IT peers. Nearly 53% cited limited visibility and 11% zero visibility, compared to 45% limited and 13% zero within the overall IT respondents. This increase raises concerns about potential security vulnerabilities and compliance issues.

SSO is widely used in corporate environments to simplify user access by reducing the number of passwords they need to remember and manage. It also improves security by centralizing the authentication process to a single provider that manages user credentials, making it easier for IT departments to enforce security policies and monitor access logs.

But with limited visibility into whether users are leveraging SSO within their SaaS apps, it can be challenging for the IT team to detect unauthorized access or breaches promptly. One effective solution is to employ SaaS monitoring tools that enable an IT team with better visibility into user activities and accounts across the organization.

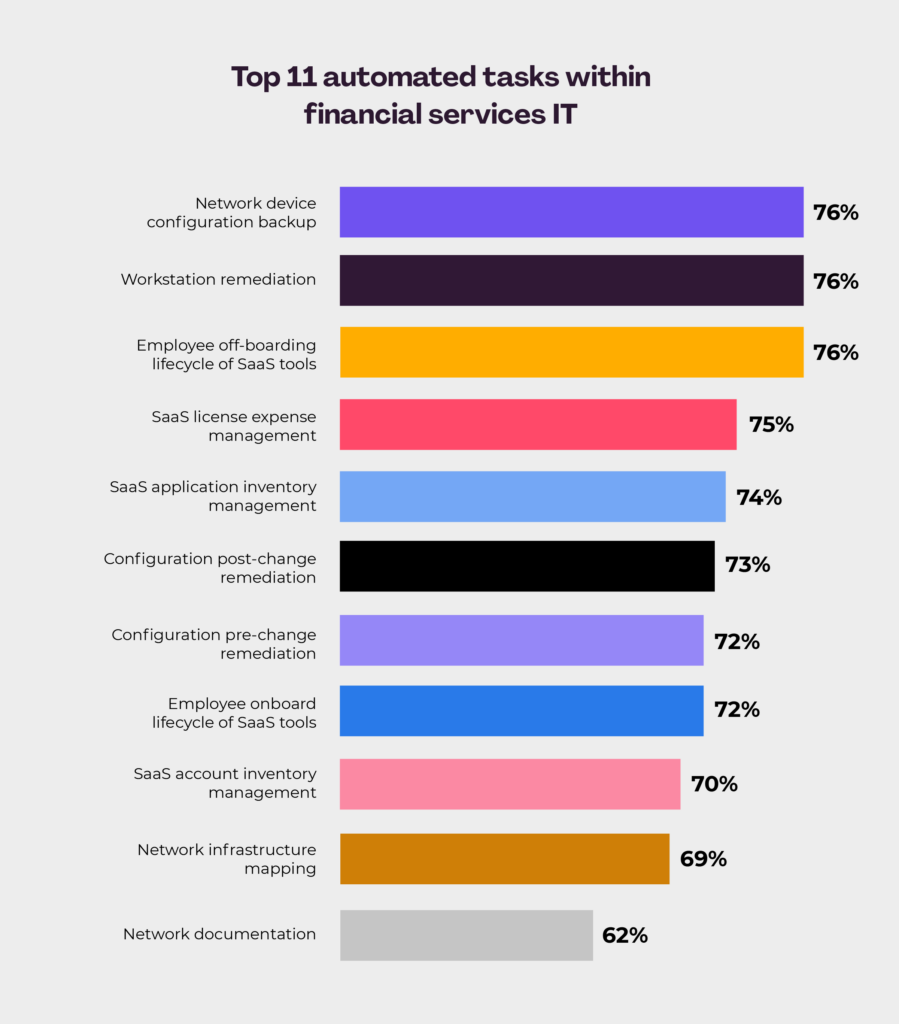

9. Financial services ITs have an appetite to increasingly adopt automation

Out of a list of network and SaaS-related activities, an average of 72% are either mostly or completely automated by IT professionals in the financial services sector.

While automation adoption is fairly similar across all survey respondents, a few outliers remain:

- Network documentation: Finance ITs are slightly less likely to automate network documentation than their general IT peers. This could be in part due to stringent regulatory requirements that call for human oversight of documentation processes.

- Workstation remediation: Compared to their general IT peers, Financial services ITs are slightly more likely to automate workstation remediation. This could suggest a higher prioritization of maintaining end-user access through swift, automated responses.

- Employee offboarding lifecycle of SaaS tools: Finance ITs are 8% more likely to automate this task, maintaining strict procedures to eliminate the potential security risks of employees accessing information once they’ve exited the company.

Despite this seemingly significant adoption rate of automation, 48% of the same group of Financial services IT professionals cited “programming and automation” as network-related activities they’d like to be doing, but aren’t. This is in comparison to just 39% of their general IT peers, suggesting a significantly increased appetite for automation in the financial services sector.

Organizations can achieve this by defining a network automation roadmap that outlines the tools and processes required to reduce manual intervention in network activities.

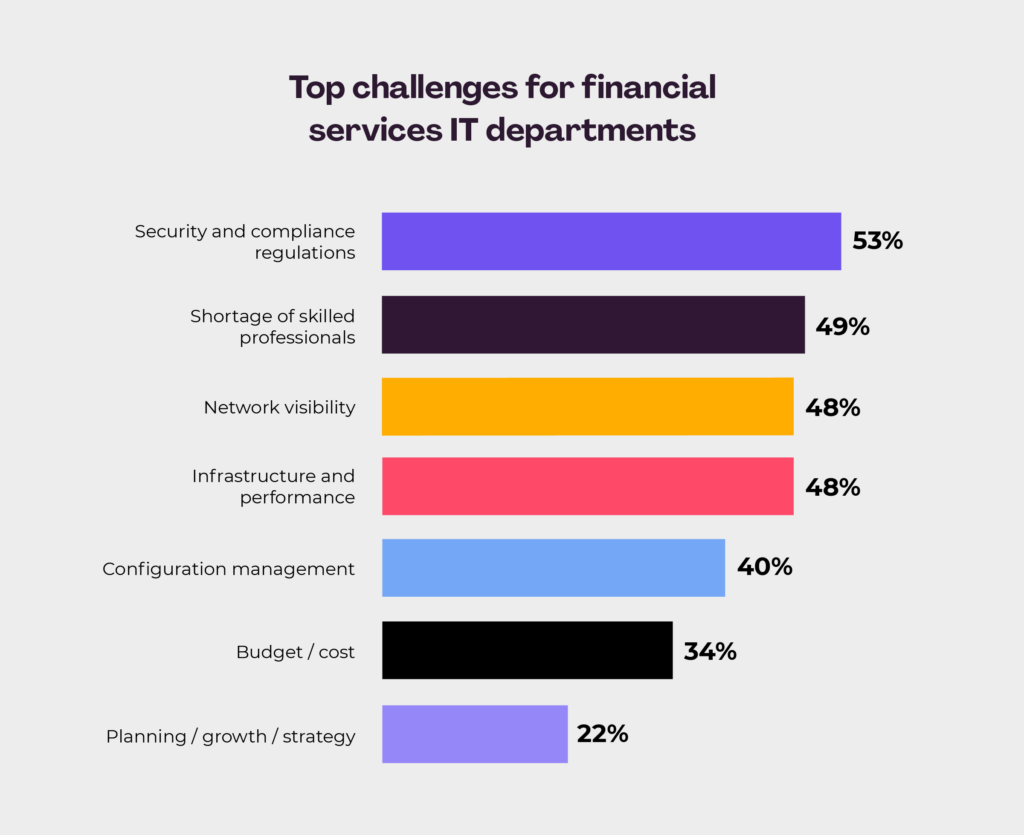

10. Security and visibility remain top concerns for finance ITs

More than 50% of financial services IT professionals cite security and compliance regulations as the top challenge they’re facing in 2024, followed by the shortage of skilled IT professionals (49%) and network visibility (48%).

Financial services firms are particularly burdened by strict regulatory demands and complex network management—challenges that are only compounded by a growing global shortage of skilled IT professionals. However, establishing relationships with IT MSPs that understand the nuance and complexities of the financial services sector could help IT teams more proactively navigate data security, and provide access to specialized talent where it’s needed most.

11. Financial services ITs are driven towards network innovation

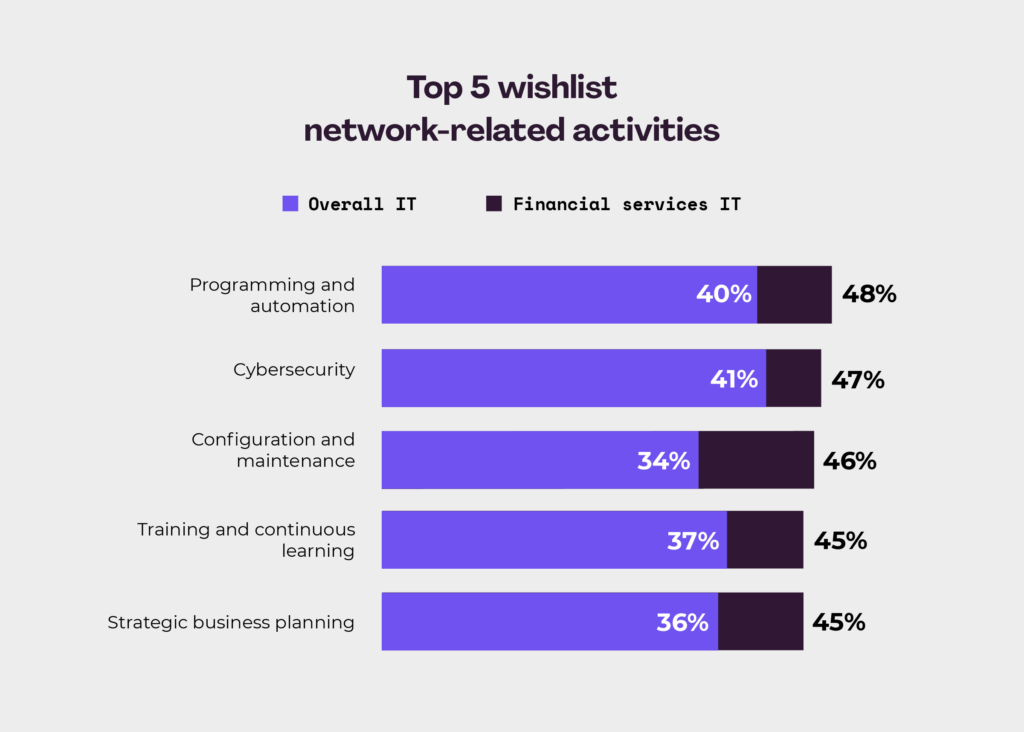

Compared to their non-finance counterparts, financial services IT professionals show a significant drive to innovate. When asked what network-related activities they would like to be doing more of, finance ITs showed higher interest across the board for the majority of activities. The top five include programming and automation (48%), cybersecurity (47%), configuration and maintenance (46%), training and continuous learning (45%), and strategic business planning (45%).

When asked what obstacles were hindering the pursuit of these activities, lack of budget (40%) and lack of authorization (40%) topped the list. Issues with access to authorization may come as no surprise in a sector where regulation and compliance are heavily weighted. But with IT spend forecasted by Gartner to grow 8% year-over-year in 2024, budget relief for financial services IT professionals may be on the horizon.

A snapshot into our survey audience

The 2024 IT Trends Report surveyed 2,000+ IT professionals to explore the current IT trends shaping their evolving roles and departments. Of these respondents, 12% (240 individuals) were from the financial services industry, providing insights into the ongoing challenges experienced by financial services IT professionals in comparison to their peers.

Here’s a breakdown of our financial services respondents’ demographics:

- Country of residence:

- 96% reside in the United States

- 2% reside in the United Kingdom

- 1% reside in Afghanistan

- Company size:

- 9% work at companies with 5,000+ employees

- 45% work at companies with 1,001-5,000 employees

- 26% work at companies with 51-1,000 employees

- 15% work at companies with 251-500 employees

- 4% work at companies with 1-250 employees

- Number of IT Ops and ITSM roles within their organization:

- 9% have 50+ on their IT team

- 37% have 21-50 on their IT team

- 39% have between 11-20 on their IT team

- 13% have between 6-10 on their IT team

- 2% have between 1-5 on their IT team

- Department of the respondent:

- 24% identified as Network Operations

- 28% identified as Network Security

- 23% identified as General IT Operations

- 8% identified as Helpdesk or Service Desk

- 8% identified as Application Management

- 5% identified as DevOps

- 3% identified as non-IT

Discover more financial services industry trends in the full report

IT is continuously changing, and keeping up with the financial services trends is essential for IT pros planning for the year ahead. Download your copy of the full report to see how these financial services trends compare to other industries and learn more about what’s on the horizon for 2024 IT Trends.